To maintain the single stage nature of the tax several exemption. Persons exempted under Sales Tax Persons Exempted from Payment of Tax Order 2018 Goods listed under Sales Tax Goods Exempted From Tax Order 2018.

IMPORT DUTY STAGING CATEGORY.

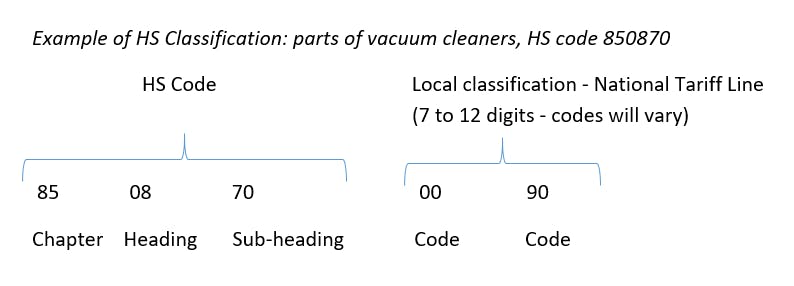

. Second Edition Sept 2016. Or b imported into Malaysia by any person. Harmonised System a series of fewer than six digits is considered a partial tariff code representing a broad category of product or chapter.

MALAYSIAS TARIFF SCHEDULE UNDER THE MALAYSIA-INDIA COMPREHENSIVE ECONOMIC COOPERATION AGREEMENT MICECA HS CODE Chapter 1 - Live animals Page 39. Hydrogen peroxide in bulk284700 exports to Malaysia in 2018 Additional Product information. Disinfectants and sterilisation productsThe data here track previously existing medical devices that are now classified by the World Customs Organization as critical to tackling COVID-19.

03- 5523 1819 Fax. Jalan Pahat H15H Dataran Otomobil Seksyen 15 40200 Shah Alam Selangor Malaysia. National Pharmaceutical Regulatory Division Ministry of Health Malaysia.

Exempt goods and goods taxable at 5 are defined by the HS tariff code of the goods as prescribed in a gazette order. Find my Harmonised System Code Singapore Trade Classification Customs Excise Duties STCCED Singapore adopts the 8-digit HS Codes in the ASEAN Harmonised Tariff Nomenclature AHTN which is based on the World Customs Organisation WCO 6-digit level HS Codes for use by all ASEAN member countries. Share Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory for the 6 digit HS Code to be declared in the Export Import and transshipment manifest in Malaysia.

It is a product-specific code as stated in the Harmonised SystemHS maintained by the World Customs OrganisationWCO. 010512000 - - Turkeys. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Any part of Malaysia but excluding a free zone Labuan Langkawi and Tioman v. Trying to get tariff data. Falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25.

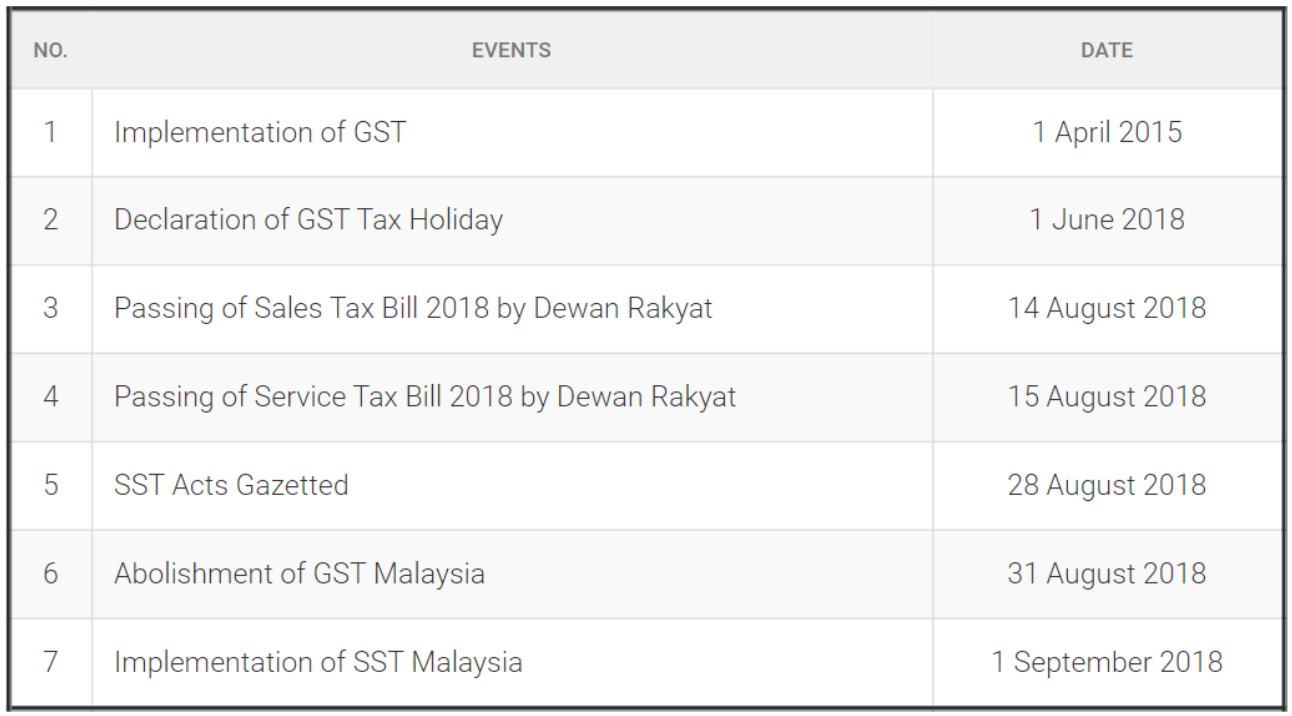

Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime. 2016 2017 2018 2019 2020 2021 2022 2023 2024 AKFTA Tariff Rate HS Code AHTN 2012 Base Rate Description Category Remark 0203-02031100 00 - - 0 HSL D. On 2 November 2018 the Malaysia Minister of Finance tabled the 2019 National Budget.

Medical Test kits HS Classification Reference based on Covid-19 medical supplies list 2. MALAYSIA - Mandatory HS 6-digits commodity code Dear Valued Customers Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. AHTN is used for trade transaction between Malaysia and the other ASEAN countries while the HS Code applies for trade with non-ASEAN countries.

A manufacturer registered under section 13 or 14 of the Sales Tax Act 2018. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. The difference between HS Code and AHTN code.

Requirment of HS code for Malaysia July 12 2018. SALES TAX 2018 GUIDE ON SALES TAX EXEMPTION UNDER ITEM 33A 33B 55 63 64 65 SCHEDULE A SALES TAX. It is presented in small.

June 2018 is the FY ending 30 June 2018. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy. SCOPE CHARGE Sales tax is not charged on.

03-5523 2827 E-mail. This is in conjunction with the implementation of the new Customs operating system uCustoms where. November 2018 Malaysia.

Requirment of HS code for Malaysia. HS Codes Chapter 01 to 98 - Check Mexican Harmonized System Code ITC CTH Custom Tariff Code HS Classification Product Code Sub Sections and Heading 91 9990837766 infoseaircoin Request Free Demo. 27 000 - - Cuts and offal frozen 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -.

However part of the work was done in GST era and the balance of work to be completed in the Sales Tax era. Revised July 2018 Page 231 41 DEFINITION 411 HEALTH SUPPLEMENT HS A Health Supplement HS means any product that is used to supplement a diet and to maintain enhance and improve the health function of human body. Subcontract work to be performed from 15 August 2018 to 15 October 2018.

Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. A manufactured in Malaysia by a registered manufacturer and sold used or disposed of by him. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods.

Last published date. Malaysia Medical Test kits 300215 exports by country in 2018 Additional Product information. What is the tax treatment on the subcontract work.

TRQ as specified in Appendix B TRQ. Harmonized Commodity Description Coding System commonly known as HS Codes and ASEAN Harmonized Tariff Nomenclature AHTN were created for international use by the Cust. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

Sales tax is a single stage tax with no credit mechanism. Know your products HS Code. Diagnostic reagents based on immunological reactions Category.

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

HS Code Description Base Rate 2005 MFN 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years 01 Live animals 0101 Live horses asses. All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis. GST is charged at standard rate of 0 on the part of work performed until 31 August 2018.

Genoa 03rd October 2018 Subject. Bulk H2O2 whether or not with solidified with urea. To assist you in your self-classification journey you may use.

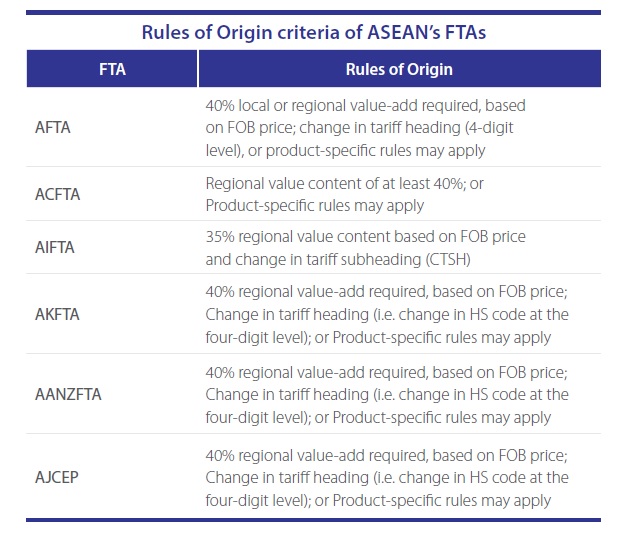

Rules Of Origin Criteria Of Asean S Free Trade Agreements Asean Business News

Countries Were Not Buying Covid 19 Test Kits In 2018 Fact Check

Maintain Tariff Estream Software

Malaysian Customs Classification Of Goods Get The Right Tariff Codes

Malaysia Sst Sales And Service Tax A Complete Guide

What Is Hs Code The Definitive Faq Guide For 2020

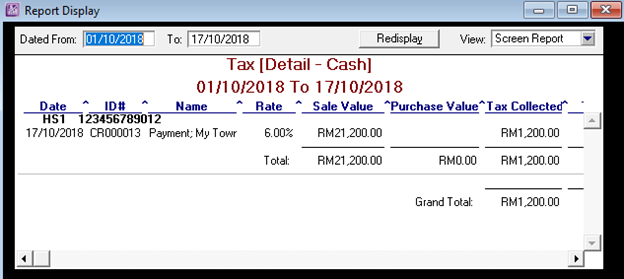

Sst Tariff Code Estream Software

Malaysia Sst Sales And Service Tax A Complete Guide

How To Record Tariff Code Using Service Layout Abss Support

What Is Your Hs Code Tariff Business Advisory Services Facebook

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Sst Tariff Code Estream Software

What Is Your Hs Code Tariff Business Advisory Services Facebook

What Is Hs Code The Definitive Faq Guide For 2020